Case Study 1: Repowering a Legacy UK Solar PV Asset

Scenario & Background

As part of a merger and acquisition technical due diligence (M&A Tech DD), GreenEnco® assessed an operational, utility-scale solar photovoltaic (PV) asset in the United Kingdom with an installed capacity of approximately 10.6 MWp DC / 8 MW AC, originally commissioned in the mid-2010s. The assessment identified severe and sustained underperformance across the asset.

The project represented a typical generation of UK solar farms now reaching a stage where legacy design choices and ageing plant configurations begin to constrain performance, reliability, and operational resilience. Rather than pursuing new development or accepting long-term underperformance, the asset owner sought to understand whether targeted repowering could unlock additional value from existing infrastructure.

GreenEnco® was engaged to evaluate repowering opportunities that could restore performance, extend asset life, and improve operational resilience while carefully managing cost, delivery risk, and disruption to the live plant.

The Challenge

Repowering an operational solar asset is inherently more complex than a new-build project. Solutions must be developed within the constraints of existing equipment, historic design standards, evolving planning and environmental regulations, and grid export limitations.

- Limited availability and completeness of historical project documentation

- DC string architecture designed to historic standards and voltage limits

- Electrical and operational constraints of the original inverter design

- Live-site construction and continuity-of-operation requirements

- Need to minimise changes to existing LV and HV infrastructure

GreenEnco® Approach

GreenEnco® adopted a system-level, asset-first approach to repowering. The study commenced with a structured desktop assessment, supported by site surveys and plant mapping, to establish the true installed condition and identify the root causes of underperformance.

The assessment confirmed that the original inverter architecture had become a critical bottleneck, resulting in reduced availability, operational limitations, and increased intervention requirements. No critical issues were identified with other major balance of plant components, allowing the repowering strategy to remain targeted to inverter systems and associated infrastructure.

Repowering Strategy & Solution

Both central and string inverter-based repowering strategies were evaluated against the existing plant configuration, electrical constraints, and delivery considerations.

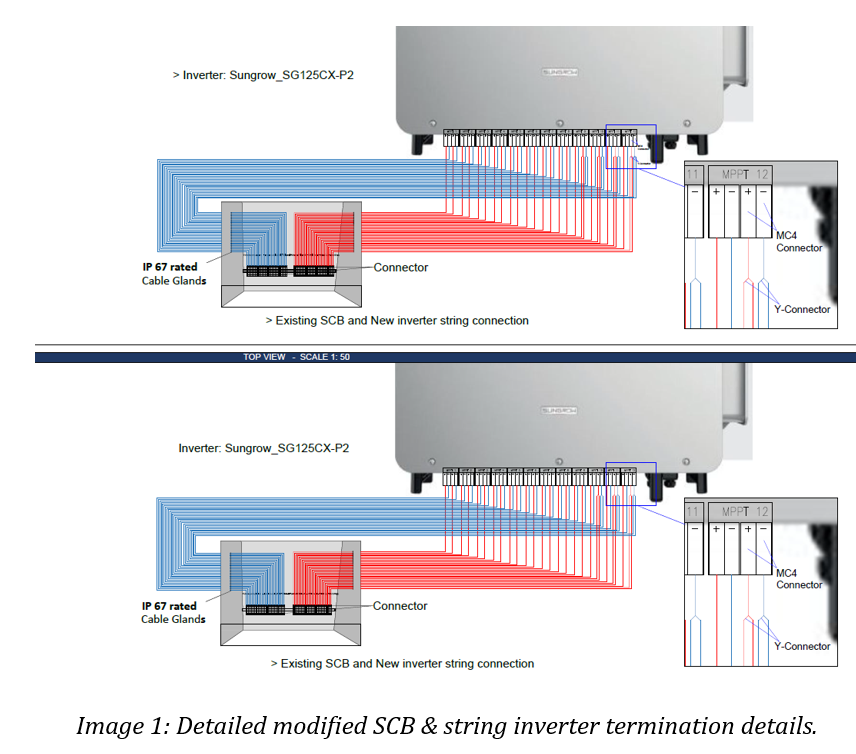

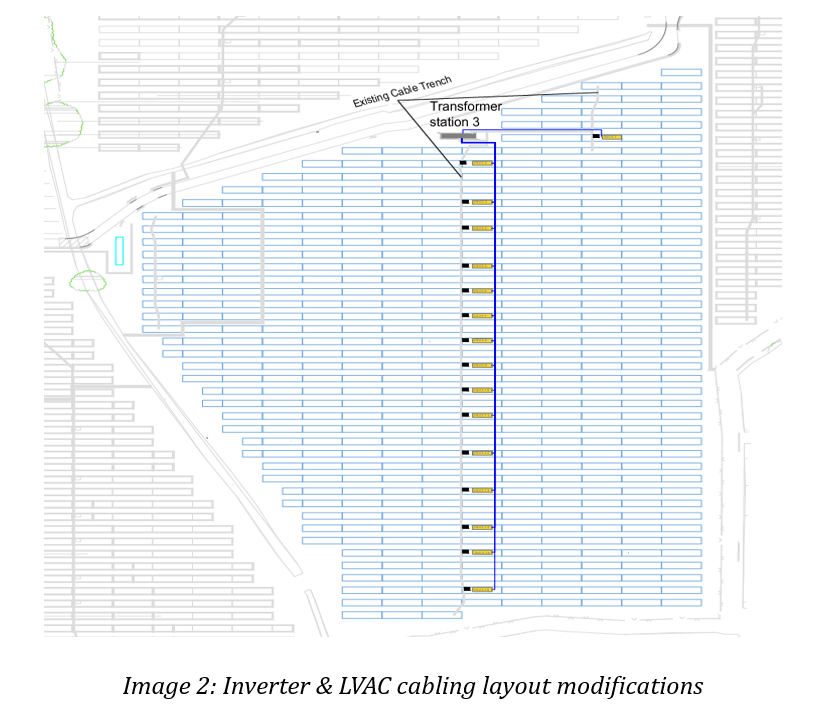

A distributed string inverter-based solution was identified as the preferred strategy. This approach improved fault tolerance, reduced single-point failure risk, and enhanced operational flexibility while maintaining compatibility with existing infrastructure.

Image 1: Detailed modified SCB & string inverter termination details.

Image 2: Inverter & LVAC cabling layout modifications.

Outcome and Value Delivered

The repowering programme significantly enhanced yield and performance while extending the operational life of the asset by up to 15 years.

- Annual energy yield improvement: typically 5–10%

- Operational life extension: approximately 12–15 years

- Availability improvement: of the order of 2–4%

- Reduced unplanned downtime and O&M intervention frequency

- Optimised capital deployment through reuse of infrastructure

Why Repowering Matters

As many legacy utility-scale solar PV assets approach a decade or more of operation, repowering is becoming an increasingly important lever for performance improvement and value protection.

This case study demonstrates how targeted, well-engineered repowering can deliver meaningful benefits without the environmental, financial, or operational burden of full asset replacement.

Kind Regards,

GreenEnco®